The Brexit vote has resulted in lot of changes in the lifestyle of Britons as they face trouble due to the falling pound as well as income crisis. In addition, commodities and services are becoming costlier and people are facing issues due to food inflation. The overall effect of Brexit is that household bills are increasing by leaps and bounds making Britons pessimistic about their own survival as well as country’s economic prospect. This creates a sense of insecurity around the households as suggested by a survey done by the analytics firm Markit.

The findings were derived from the monthly Markit Household Finance Index, consisting of 1500 respondents. The results of the survey came at a time when the Prime Minister initiated Article 50 and the exit of Britain started from the EU on the 29th March. Looking at the pace of events it is clear that things are becoming difficult for an average family that needs to make savings by option for best deals of the day or relying on the cheapest deals in energy, insurance and other essential services.

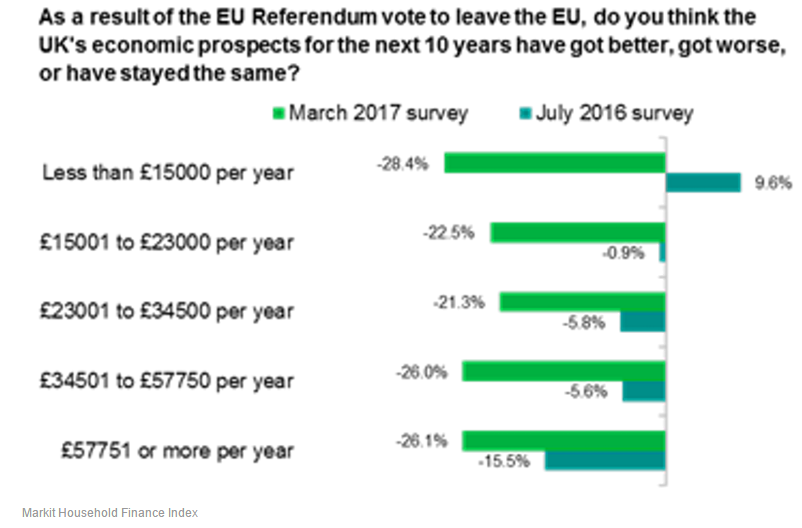

The survey revealed that people are losing hope as the percentage of people that expected economy to grow in a decade has dropped from 39% to 29% since July 2016. Also, the number of people thinking UK’s economic prospects are facing downturn has increased from 42% to 53%. The survey also brought forth the fact that the country’s lowest income group has become pessimistic about the results of Brexit. They feel deprived of basic facilities like cheaper energy deals, home and car insurance and travel deals.

Following figures suggest the results of the survey in detail:

Chris Williamson, chief business economist at Markit, said: "Whereas opinions on the long-term impact of Brexit were finely balanced in the immediate aftermath of last June’s vote (albeit leaning towards pessimism), a negative view of the economic consequences has become increasingly apparent and widespread.

"Pessimism has now spread to all age groups and income brackets. Shortly after the referendum, the older generations and the very poorest families were the exceptions in considering Brexit to be beneficial to the long-term health of the economy. However, even these pockets of the population have now become pessimistic.

"The most marked turnaround is evident among the poorest paid, who have switched from being the most optimistic to now being the most downbeat."

To survive this condition, households can only rely on savings made on commodities and services. They can choose energy suppliers that offer the cheapest home energy plans to cut down a major chunk of their energy bills. In addition, they should make online purchases that save them up to 60% or more by choosing top deals of the day. Overall, they should make a habit of shopping around so that they can benefit from the latest discounts offered to the new customers.

Comparing prices can be a huge task that demands time and if anyone is not comfortable making those calculations then they can rely on energy price comparison sites like FreePriceCompare. The company offers price comparison for various essential services like travel, insurance, loan, broadband plans and more. We offer comparison services for free and are trusted by a huge customer base spread across the UK. If you want to get the cheapest home energy deals or want to buy things through best daily deals then call the friendly and meticulous team of comparison experts on 02034757476.

Author Bio:

Arjun Vishram is a financial advisor at Freepricecompare.com and a passionate blogger. He writes on personal finance and money-saving tips. He suggests all UK households to compare home energy prices before renewing energy contract with existing supplier. When he isn’t writing, he is spending time to find advance technique of farming and its way of applying. He also plays his guitar gifted by his father.